Sharing is caring!

If you are ready to make some changes to save more money, pay down debt or spring clean your finances, a 30 day personal finance challenge may be what you need.

Most of good money management is boiled down to our daily habits. If you can identify those habits causing problems in your budget you can begin to change those habits and improve your financial health.

The problem with bad habits is we do these things almost unconsciously.

That’s where a 30 day personal finance challenge comes in.

The beauty of a 30 day challenge is it is long enough to help you build better habits but not so long that it seems incredibly daunting.

How Do I Start a 30 Day Personal Finance Challenge This Month?

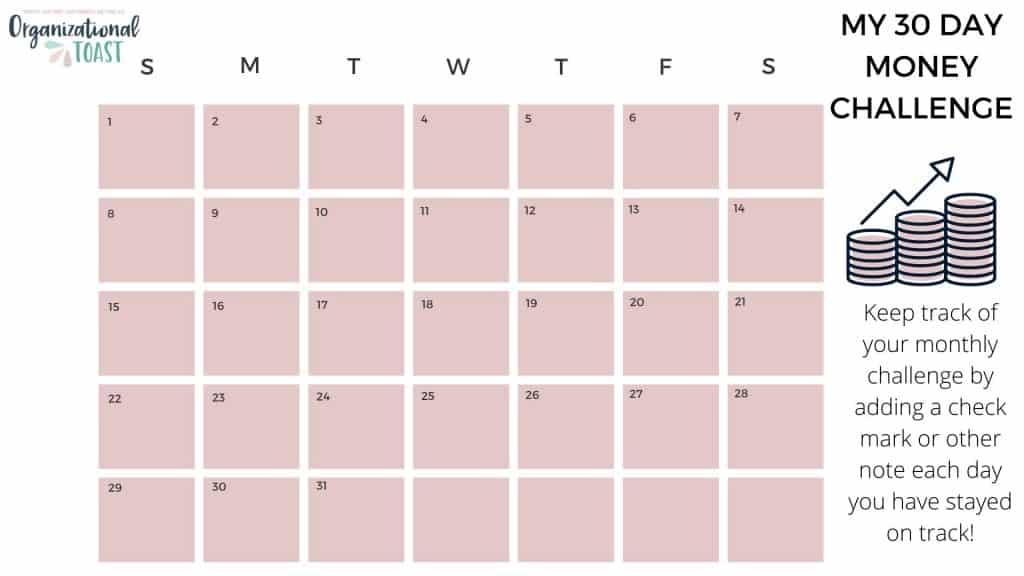

If you’re ready to get started with a 30 day challenge, I recommend starting on the first of the month, simply because it’s easier to keep track of your progress!

I also recommend reviewing your calendar for the month. You don’t want to take on a 30 day no spending challenge the month of December when you know you’ll be buying Christmas presents. Or keep a daily budget diary when you know you’ll be having an atypical month in terms of spending or expenses.

With that being said, there is never a perfect month for any challenge so don’t make too many excuses. Pick a challenge that helps you change your habits but also make sure you set yourself up for success.

30 Day Personal Finance Challenges to Improve Your Life

No Spend Month

A no spend challenge is a great way to cut out all unnecessary spending for an entire month.

The basic premise is that you commit to not spending any money on anything outside of the necessities (things like your mortgage, groceries etc).

It’s a great way to jump start some serious savings or simply cut back.

I’ve used the no spend challenge to break the habit of buying the “little things”. You know, like buying the little extras at the grocery store or gas station.

It’s also a great way to figure out what you can live on without all the unnecessary spending.

You can check out my best tips to successfully complete a no spend challenge here.

30 Day No Credit Card

Find yourself swiping away during the month and ending up with high credit card bills? It might be time for a no credit card challenge.

This challenge is meant to help you break the habit of reaching for the credit card for every purchase and instead choosing cash.

According to this study paying cash is more painful and will make you value your purchases. You’ll think through those purchases and give purchase decisions more weight when you pay with cash.

Dave Ramsey’s Total Money Makeover provides some amazing guidelines to help you set up a cash only system.

Keep a Budget Diary

This challenge is perfect for the person who knows they need to manage their money better but aren’t exactly sure where to start.

The idea is simple.

At the end of each day, write down everything you have spent money on. You can use a notebook, spreadsheet, or download this free spending log.

At the end of the month, review your spending.

Having your spending habits laid out in front of you can be a really eye opening experience.

When I first did this challenge, I realized we were spending $400 a month eating out for 2 people. I had NO idea it was actually that much.

Seeing it on paper made me so aware of my poor spending choices and helped me get my financial priorities in order.

Increase Your Savings

If you have a big money saving goal you are trying to reach, this is a great way to make some real progress.

Whether you are looking to build your emergency fund or save up for a vacation, increasing your savings for one month only can help you make real progress.

For this challenge, I recommend you automate those savings withdrawals.

Based on your monthly budget, choose a set amount to withdraw for each pay period within a 30 day period.

By setting the withdrawals automatically you can avoid spending that money before you save it!

You can supercharge your savings my using a high yield savings account like those offered from CIT Bank!

Meal Planning

Overspending at the grocery store and eating out are two areas of a majority of family budgets that cause a lot of stress. And meal planning is the simple solution that can change all that!

For this challenge, you’ll commit to creating a meal plan for the month.

That doesn’t mean no eating out or bare bones grocery shopping.

It simply means having a plan for your daily meals to avoid buying too much at the grocery store and throwing it out or going through the drive thru.

I have a FREE meal planning guide to help you get started with meal planning and you can check out my best meal planning tips here.

How do I stay on track?

Before you begin any of these challenges, take some time to asses WHY you want to take on this challenge.

Knowing your end goal will help keep you focused. The more detailed your why the more likely you will be to complete the challenge.

Then imagine what it will feel like to have completed the 30 day challenge.

For example, if you are taking the no credit card spending challenge, imagine how good it will feel to have no additional charges on your credit card, or even better a zero balance. Every time you start to feel like you can’t finish the 30 days, go back to that feeling.

I’ve also created this money challenge tracker to help you keep track of all your wins! You can right click and download the image below or I have a link you can use to get a pdf version.

There are also ways that you can actually earn money on your savings. Using an app like SaverLife helps you stay motivated and on track PLUS you can earn cash rewards and prizes for reaching your goals!

Looking for more tips to help manage your money? Check out: