Sharing is caring!

Do you want more money? Do you want to be stress free when it comes to your finances? Do you think making more money will solve all your financial woes?

Well friend, I’m here to tell you that no matter how much money you have, if you don’t have a plan for your money you will never have enough of it.

You will continue to feel stressed about your finances. You will continue to be frustrated every month.

By creating a budget, you can have complete control of every dollar that you earn and can make good financial decisions to help you meet your financial goals. And if at that point you decide you need more income than you know exactly how much more income you actually need.

When I first made the decision to begin budgeting I was overwhelmed. I felt like it would take so much work and would create even more stress around my finances than I already had.

Guess what? I was so wrong.

Instead, I learned that there is a sense of freedom from knowing exactly how much money is coming in and going out.

I also discovered that a budget does not mean bare bones or frugal living. Having a budget simply means having a plan for your money so you don’t end up thinking “what happened “ at the end of the month.

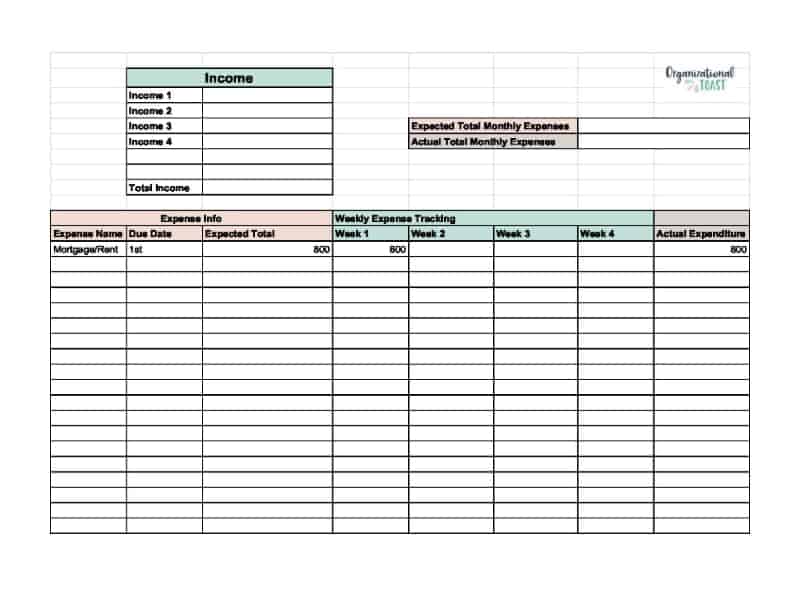

All it takes is 4 steps to make a monthly budget. The first budget you create will take you the most time so don’t be daunted! I also created this easy budget worksheet to help you get started!

How To Make A Monthly Budget In 4 Easy Steps

Step 1: Write Down All Your Expenses

This list of expenses should be as complete as possible. You must go beyond just the most obvious expenses such as rent/mortgage, car payments etc. Here is a complete list of all our budget items this month. This list can and will change from month to month.

Mortgage

Car payment

Car Insurance

Cell Phones

Internet

Water

Electricity

Life Insurance

Personal Savings

Kids College Savings

RV Storage

Gas (Home)

Gas (Car)

Groceries

Prescriptions

Pet Care

Hair Cuts

Fun Money

School Tuition

Pike Pass

Dance Class Tuition

Home Upkeep

How did I come up with this list? I looked over 3 months worth of statements to see what our recurring costs were and determined which categories I should include and how much we spent on each of these categories. If you have credit card debt, or any other forms of debt write down your minimum monthly payment.

On the Free Create A Budget Sheet, you will list your expenses details in the set of expense columns.

Step 2: Write Down All Your Income

Write down the total amount of money you expect to receive for the month. If you have variable income, write down the lowest amount you expect to receive that month. Include all forms of income including child support etc.

Step 3: Subtract Your Total Expenses from Your Total Income

If this number is negative, you know you need to find a way to reduce your spending in some of your budget categories. In some cases it might be as simple as creating a meal plan to reduce how often you eat out. In other cases, you may need to make several adjustments to make sure you’re not in the negative.

If your total is not in the negative, give those extra dollars a job. Plan to save that extra $50, $100 or $200. Or make extra payments towards any debt that you have.

Step 4: Track Your Spending Weekly

Just creating a budget isn’t going to magically help you reach your financial goals. Sticking to it takes commitment and focus. The easiest way to stick to your budget is to track your spending each week. For our family, we sit down on Thursday evening to see what has been spent in each categories. This gives us a picture of how much money we have for the rest of the month. We also make adjustments based on our spending if necessary.

On the Free Create A Budget Sheet, you can track your weekly expenditure for each week to help you easily track your spending.

My final piece of advice is don’t fear a budget! Learning how to make a monthly budget is a skill so many people are scared of but is the most necessary tool for reaching your financial goals.

Check out all my budget resources to help you get started!

21 thoughts on “The Easiest Way To Make A Monthly Budget”

Great tips! Love that you included a budget worksheet too – very helpful!

Thanks Nikki!

I am reading this at the perfect time as my husband and I were just talking about making a monthly budget – yes, pretty bad we don’t currently have one. I’m going to share this with him so we can get started this week. Thanks for the tips!

This is a great time of year to get started with budgeting and to come up with some great financial goals for the upcoming year. Sometimes the hardest part of budgeting is getting started. Good luck!

This is all great advice and I really need to take note of it. We have a very difficult time sticking to the budget when we are a one income family and my husband gets paid every other week.

I was right there with you! The biweekly paycheck can make it trickier to plan out the month, but it’s not impossible.

This is a great time of year to create a monthly budget. It’s easy for things to get out of control with spending. Great ideas!

So true. And the new year is also a great time to start fresh and come up with financial goals for 2019!

Great tips and love the worksheet! We are huge fans of budgeting and do it monthly and will implement some of your tips next month!

I’m so glad you found this helpful. Having a worksheet has helped me so much. I prefer it over using an app or just paper and pen (like I did when I first started).

I just started budgeting, and I love it…until I fall off the wagon, lol. Thanks for sharing some tips!

Hi Kelly, it’s so easy to fall off the wagon. Budgeting is definitely a habit that takes time to build. And even the best budgeters fall off the wagon from time to time!

Great tips! I used to be scared of budgeting too. Yet, once I learned how to budget correctly and why to budget, it is so freeing.

Thanks Ayanna!

I cannot live without a budget!! Love this organized approach. When my husband and I first got married we were always saying the “what happened” at the end of every month lol definitely a learning experience – this article will definitely help people who are just getting started or need that extra push!

I know! Once you get in the swing of having a budget it’s hard to imagine life without it.

Thank you so much for the tips, Jill. This is definitely what I need! I have been wanting to start a budget for so long – this will get me on track for sure.

I’m glad you found this useful Alexandra. Sometimes just getting started is the hardest part. Good luck!

Great tips! We really need to get on this!!

Thanks Erin!

Pingback: Effective Ways to Prepare Financially for a New Baby