Sharing is caring!

Do you want to know what the secret to our debt free success is? Tracking our spending with a spending log.

When we first committed to becoming debt free, we sat down and reviewed 3 months’ worth of our spending to help us create our budget.

And what we found was SHOCKING!

The truth is we were over spenders.

And a lot of our over spending was incredibly subtle.

There were so many small purchases that turned out to be major leaks in our budget.

Things like our afternoon Starbucks run at work.

Or all those drive thru “cheap dinners” we picked up because neither me or my husband felt like cooking.

Or that chapstick at the grocery checkout.

And don’t even get me started on the Target dollar spot!

Sound familiar?

Not only did reviewing our spending during this initial phase of planning our budget open our eyes to our spending habits, it also made us realize we had to be more aware of how we were spending our money.

That’s when we decided we need to start tracking our spending.

We started noting our spending every.single.day.

At first it was really difficult, but soon our spending habits started to change and we began to see actual results.

You know, like paying off $40,000 worth of debt in less than a year while we were a single income family.

If you are ready to see some major results and stop your overspending habits, you need to start tracking your spending with a spending log!

What is a Spending Log?

A spending log is a tool you use to track your spending to ensure you are sticking to your budget.

A spending log can be done with paper and pencil, with a spreadsheet or even with an app like mint or everydollar.

But whichever form you use the concept is the same.

You are tracking your spending and making sure that you don’t go over budget in any budget categories.

Have you ever heard of people using a food journal to track what they eat each day to help them create better eating habits and succeed with a diet? Well, a spending log is your spending journal for your financial diet.

Why is a Spending Log Important?

A spending log is important because it makes sure you know exactly how much you have spent and how much you have left to spend.

Using this toll will help to identify small holes in your budget. By tracking every dollar you spend you’ll notice patterns and where you may unconsciously spend money unnecessarily.

It will also help you to refine your budget and identify places where you can reduce your spending.

Need help creating a budget? Check out The Easiest Way To Create A Budget.

In addition, you may discover you are spending less than your allocated amount in a budget category and always more in another.

For us, we realized we were spending less on gas each month and more on groceries. So when we sat down to do our budget the next month, we re-allocated some of our gas money to our grocery category.

A spending log will also help to prevent you from overspending.

When you know how much money you have already spent in each budget category, it’s easier to curb your spending and make better financial choices.

What Should I Use To Create My Spending Log?

It doesn’t matter where you keep track of your spending.

What matters is that your spending log is easy to use and accessible when you need it.

Here are a few of the most popular options:

Notebook– Simple pen and paper is the easiest low tech option anybody can use. No need to worry about your password or having access to your computer.

Spreadsheet – If you love a good spreadsheet, this can be a great way to track your spending. You can even use formulas to help automate some calculations!

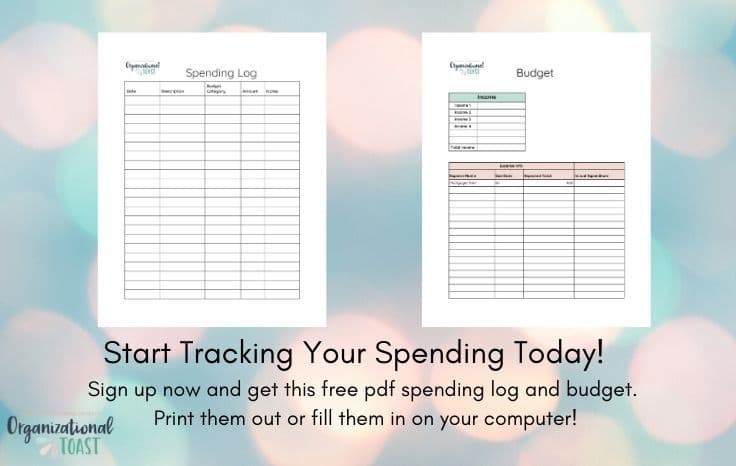

Organizational Toast Spending Log Template – I have created a spending log template that you can either print out or download and fill out on your computer. You can access it here for free.

How To Fill Out A Spending Log

The more detailed you are when tracking your spending with a spending log:

- The easier it will be to identify spending habits

- The more likely you are to change those habits

- The less likely you will overspend.

Your spending log should include:

- Date – Day/Date of the purchase

- Description – What did you buy?

- Budget Category – Which category is this assigned to?

- Amount – How much did you spend?

- Notes – Any other information you want to take down.

I include a notes field because I use it to remind myself why I made the purchase. Sometimes at the end of the month, I review those notes and realize that something I thought was a need was unnecessary and I could go without.

Get access to my free Spending Log and Budget PDFs to help you get started.

This has helped me pinpoint my spending triggers and given me a whole new perspective to wants vs. needs.

I encourage you to use that notes field to also write down how you felt about the purchase. Did you have buyers remorse after? Were you stressed and wanted to feel better?

These important details can be a big game changer. As Dave Ramsey says “Personal Finance is 80% Behavior. It’s only 20% knowledge”.

How Often Should You Fill Out Your Spending Log?

There is no right or wrong answer when it comes to filling out your spending log.

Ideally, fill out your spending log daily. You can either review your spending at the end of each day or at the start of the next day.

Why daily?

Tracking your spending daily is more manageable. If you are only making a few purchases a day, it should take you 10-15 minutes to complete your spending log.

It also keeps you aware of your spending.

I know that some people will fill out their spending log weekly.

Beware: if you fill out your spending log weekly it’s easier to fall back into bad spending habits and to overspend.

Pro-tip: Make it a point to keep your receipts! Lots of times when we go to a store we may make only one purchase but the items we bought are from multiple budget categories. Having the receipt will make it easier for you to be more precise with how much you spent!

Looking for tips and tricks to improve your budget and financial health? Check out:

Must Read Getting Debt Free Books for Your Debt Free Journey

Dave Ramsey Baby Steps: 4 Things We Did Differently